Contents of this page

- Compulsory settlement in 2026: your starting point as a creditor

- What is a restraining order?

- Your position in a business forced composition agreement (WHOA)

- Your position in a private forced composition (287a FW)

- The cooling off period: what do you need to know?

- The cost: what does it get you?

- Acting strategically in debt restructuring

Compulsory settlement in 2026: your starting point as a creditor

Are you facing a debtor who is offering a forced composition agreement? Whether it is a company (B2B) or an individual (B2C), a forced composition often feels like a fait accompli. Yet as a creditor, you have more control than you think.

In 2026, the rules surrounding the WHOA and the Bankruptcy Code are more complex than ever. But precisely because of this, clear frameworks also emerge within which you can oppose an unreasonable proposal or safely agree.

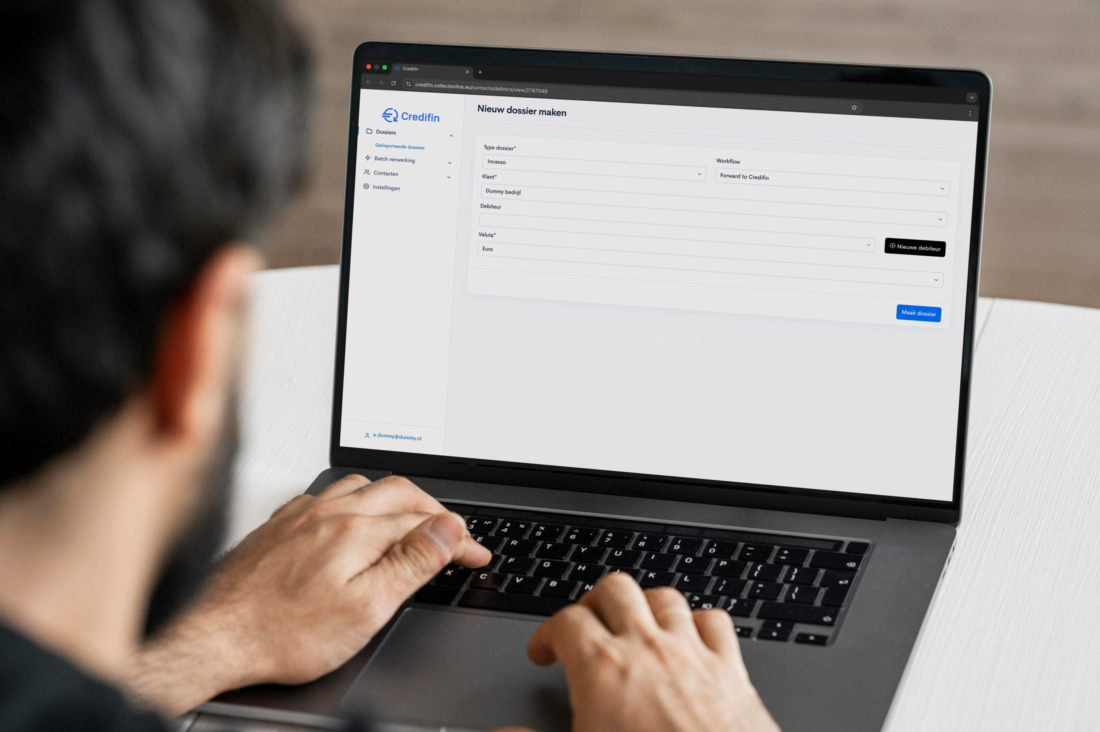

Credifin helps you navigate through these rules. From reviewing grades to preparing opposition in court. Want to know where you stand quickly? Then choose what best suits your situation: Legal advice for creditors

Want more background on the WHOA itself first? Then also read the article Compulsory settlement agreement (WHOA): what can you do as a creditor?

What is a restraining order?

A compulsory settlement is a legal procedure in which a debtor asks the court to impose a payment plan on all creditors. This includes creditors who voted against the proposal.

In 2026 you roughly distinguish between two main forms:

- Business (WHOA): Companies in financial distress can try to avoid bankruptcy by restructuring debts through the Homologation Private Arrangement Act. The court can declare this agreement binding on all classes of creditors.

- Private individual (Article 287a Bankruptcy Law): A private individual who makes a proposal through municipal debt relief can go to court if one or more creditors refuse. The judge can force those refusers to cooperate anyway through a forced composition.

Important to know: a coercive agreement is not a non-binding proposal. Once it is approved, you are basically bound by it. This is precisely why it is so important to have the proposal thoroughly reviewed in advance.

Your position in a business forced composition agreement (WHOA)

The WHOA is a powerful tool for companies in dire straits. But the law protects you as a creditor from arbitrariness. So you don't have to just agree.

At least you have strong arguments to resist if:

- The "best interest" principle is violated: You should never receive less under the settlement than you would reasonably receive in bankruptcy. Do the figures show that you are better off in liquidation? Then the settlement is contestable.

- The class division is incorrect: Creditors are placed in different classes. Large organizations sometimes try to place creditors in an unfavorable class to distribute voting power. Credifin helps you verify that you are legally placed in the correct class.

- There is lack of transparency: The debtor must provide full disclosure of assets, debts, income and restructuring plans. Are figures missing or incorrect? Then you can ask the judge not to homologate the agreement.

In complex WHOA processes, it is often smart to link your opposition to a broader debt collection plan or possible court proceedings. That way you increase the pressure and the likelihood of a better proposal.

Your position in a private forced composition (287a FW)

For individuals, the focus in 2026 is very much on a quick clean slate. Still, that doesn't mean that you as a creditor have to just swallow everything. You can successfully oppose a compulsory settlement if you have good arguments.

Examples include:

- Your refusal is not unreasonable: For example, if the debtor conceals assets, such as crypto, a car or excess value on a home, or if the repayment capacity is calculated incorrectly.

- The new repayment period of 18 months is not taken seriously: Since the shortening of rehabilitation paths, the debtor must make maximum efforts during that period. We will help you test whether that is actually happening.

- There is fraud or wrongful debt: Debts incurred through fraud or wrongful acts often may not be simply eliminated in a compulsory settlement.

By filing a timely objection and getting the right information on the table, you can prevent your claim from being unjustly waived (in part).

Would you like someone with experience to look over your shoulder? Our debt collection page shows you how we can help you with this type of case.

The cooling off period: what do you need to know?

In 2026, a debtor can ask the court for a cooling-off period, often for a period of four months. That period is intended to create calm around the company or person seeking to restructure.

During this cooling off period, the following usually applies:

- You may not seize property or bank accounts again

- Ongoing foreclosures (such as attachment proceedings) are paused

- A bankruptcy filing cannot simply be continued

That may feel like you're on the sidelines, but it doesn't have to be. In fact, you can use this time strategically:

- Complete your file and properly record all communications and invoices

- Analyze the debtor's financial figures and plans

- Have scenarios calculated: what does agreement mean, what does bankruptcy mean?

That way you will be ready as soon as the cooling-off period ends or the judge makes a decision. The better prepared you are, the stronger you will be in further negotiations or proceedings.

The cost: what does it get you?

Accepting a compulsory settlement often feels like a loss. Yet in practice, it can be the most profitable choice. The trick is to put the numbers honestly side by side.

Broadly speaking, you often see the following picture in 2026:

- Agree to a forced settlement: You often receive between 5% and 30% of your claim, sometimes a little more or less depending on the situation.

- Bankruptcy: After the trustee's costs, unsecured creditors are often left with only 0% to 5%.

In addition, you as a creditor incur costs for advice and guidance. In principle, the preparation of the compulsory settlement itself (such as a restructuring expert) lies with the debtor.

Credifin helps you conduct a clear cost-benefit analysis. Among other things, we look at:

- The amount of your claim

- Chances of receiving more or less in bankruptcy

- Proposal quality and class certification

- The cost and lead time of any proceedings

This allows you to make a conscious choice: does resistance make sense, or is a strategic conditional acceptance the best path to cash flow? Want to know how such a process works in practice? Then also read more about legal proceedings or see how our collection process is structured.

Acting strategically in debt restructuring

A compulsory settlement is not a fixed end point. It is a legal process in which you as a creditor have clear rights. Whether it is a complex restructuring of a company or a private debt settlement: your strategy ultimately determines your return.

Knowledge of the Bankruptcy Code, WHOA and the Wki is indispensable in this regard. By responding promptly, asking critical questions and requesting the right information, you avoid losing a claim unnecessarily.

Have you received a proposal for a restraining order? If so, don't let it run its course. Let the experts at Credifin look over it with you so you know exactly what choices you have and which scenario will benefit you the most.

Get your restraining order reviewed without obligation

Have you received a proposal for a restraining order and are unsure what to do? Send us the agreement and the most important documents. We'll look at it with you, explain your options in clear language and help you choose between agreeing, negotiating or objecting.

Legal resources from our knowledge base

BV of your debtor deregistered with debts? That way, as a creditor, you still get your money.