No, the court does not accept payment arrangements. The full amount must be in the court’s account by the deadline. At Credifin, we can sometimes help with pre-funding if we fully manage your collection process.

What is court fee?

In almost every court case in the Netherlands, you have to pay court fees. These are the costs you pay to the court so that your case is registered, handled and a judgment is rendered. You do not pay this amount to your opponent, but to the court itself.

All amounts on this page are as of Jan. 1, 2026. Rates are officially increased by 2.94% compared to 2025. So you have a current and realistic picture of the costs.

What exactly is court fee?

Imagine court fees as the court's administrative costs. The judge reads your file, prepares the hearing and writes the ruling. To do this, the court incurs hours and costs. That is why the government charges a contribution in the form of court fees.

Note that court fees are separate from other costs you may have, such as:

- Your attorney's fees

- The cost of the bailiff delivering the subpoena

- Costs for experts or witnesses

A nice advantage: you do not pay VAT on court fees. So there is no extra percentage on top of the amount the court charges.

The rules of thumb

- Who starts, pays: usually the party who starts the case pays the court fee first

- Company or individual: companies such as a bv or nv pay more than individuals

- Low income: if you have a low income, you can often litigate at a lower rate

- Winner often gets back: if you win the case, the other side usually has to reimburse your court fee

Court fees by type of lawsuit

You do not pay the same amount of court fees in every case. The amount depends on the type of court, the amount of your claim and who you are under the law: individual, business owner or legal entity.

Who pays the court fee?

Who gets the bill depends on the type of proceedings and your role in the case.

- Cantonal court (up to and including €25,000): Only the plaintiff, the one who starts the case, pays court fees. The defendant does not pay court fees, even if he or she defends.

- Civil court (above €25,000): both plaintiff and defendant pay court fees as soon as they appear in the proceedings, for example by issuing a summons or filing a statement of reply.

- Administrative law: the person who disagrees with a government decision and appeals pays the court fee.

Court fees in subdistrict cases

The district judge handles relatively smaller and low-stakes civil cases, such as:

- Collection cases over unpaid invoices

- Labor disputes

- Rental issues

- Consumer Affairs

- Receivables up to and including €25,000

Most collection cases fall under the subdistrict court. You don't need a lawyer here. Legal guidance through Credifin is wise, though, so you don't make mistakes in the summons or trial.

Court fees in civil cases over €25,000

If it involves a higher claim or a more complex case, you often end up in the civil chamber of the court. There, too, you pay court fees. The amount of the court fee then depends on:

- The value of the item or claim

- Whether you are a natural person, e.g. individual or sole proprietor

- Whether you are a legal entity, such as a bv, nv, foundation or association

In civil cases above €25,000, a lawyer is required. The costs here are often higher than in the district court.

Difference between civil law and subdistrict law

Civil law is the collective term for all rules between citizens and organizations. Think of contracts, rent, labor and liability. Subdistrict law is part of that civil law and focuses on smaller and low-threshold cases in the subdistrict court.

Briefly:

- Civil law is the broad area of law for disputes between parties

- Canton law is the civil jurisprudence of the cantonal court for cases up to and including € 25,000 and a number of specific topics

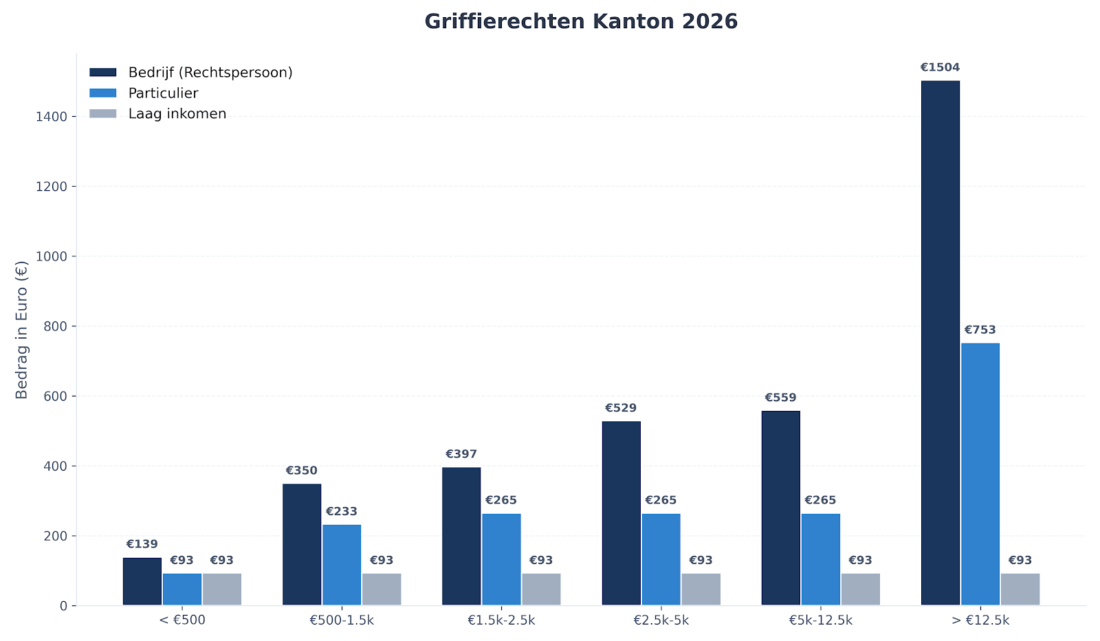

Diagram subdistrict court fee 2026.

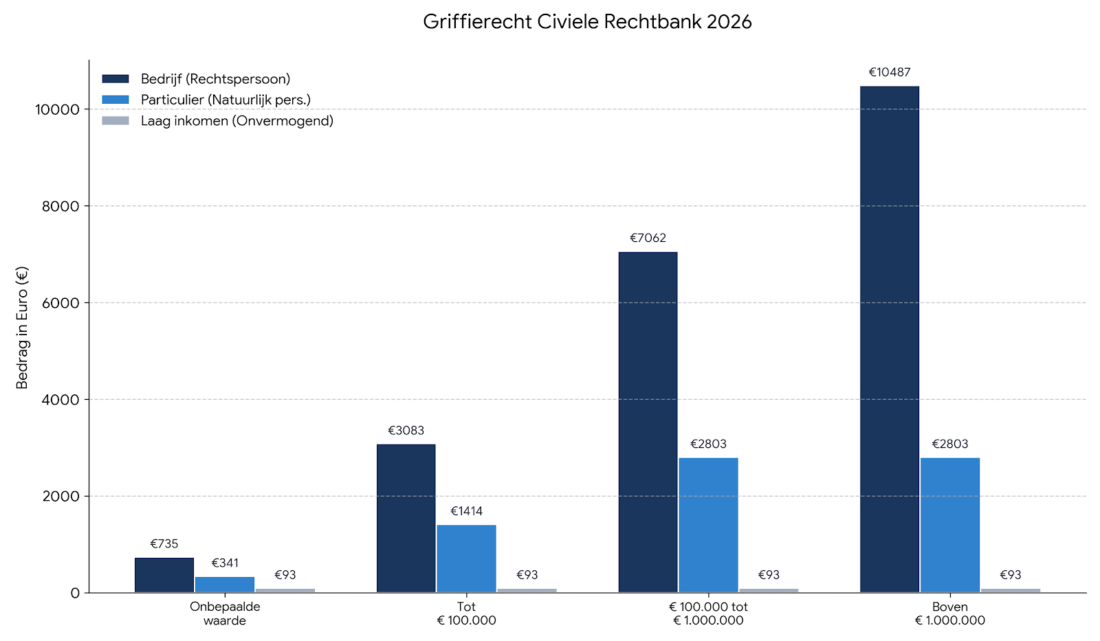

Diagram showing court fees at district courts in 2026.

Court fee rates in 2026.

To know what amount you will pay in court fees, you must first determine which group you fall into:

- Natural person: you as a human being, even if you are a sole proprietor or self-employed person

- Legal entity: a company such as a bv, nv, foundation or association

- Impecunious: someone with low income and little savings who qualifies for the low rate

The amounts below apply as of January 1 2026 and are rounded to whole euros.

1. The district judge (monetary claims, rent, work).

In the subdistrict court, only the party starting the case pays court fees. Most collection cases, rent disputes and employment cases go to the subdistrict court. The opposing party (the defendant) does not have to pay court fees in these cases.

| How much money do you demand? | Company (bv/nv/vof) | Person (self-employed/private) | Low income* |

|---|---|---|---|

| € 0 to € 500 | € 139 | € 93 | € 93 |

| €500 to €1,500 | € 350 | € 233 | € 93 |

| €1,500 to €2,500 | € 397 | € 265 | € 93 |

| €2,500 to €5,000 | € 529 | € 265 | € 93 |

| €5,000 to €12,500 | € 559 | € 265 | € 93 |

| €12,500 to €25,000 | € 1.504 | € 753 | € 93 |

| Undetermined value | € 139 | € 93 | € 93 |

* Low income: you fall into the insolvent category and qualify for the low rate.

2. Civil court (large cases over €25,000).

For large claims or complicated damage claims, you come to the civil chamber of the court. Here a lawyer is required. Both plaintiff and defendant pay court fees once they participate in the proceedings.

| Value of the business | Company (bv/nv/vof) | Person (self-employed/private) | Low income |

|---|---|---|---|

| Undetermined value (no apparent monetary amount) | € 735 | € 341 | € 93 |

| Up to € 100,000 | € 3.083 | € 1.414 | € 93 |

| €100,000 to €1,000,000 | € 7.062 | € 2.803 | € 93 |

| More than €1,000,000 | € 10.487 | € 2.803 | € 93 |

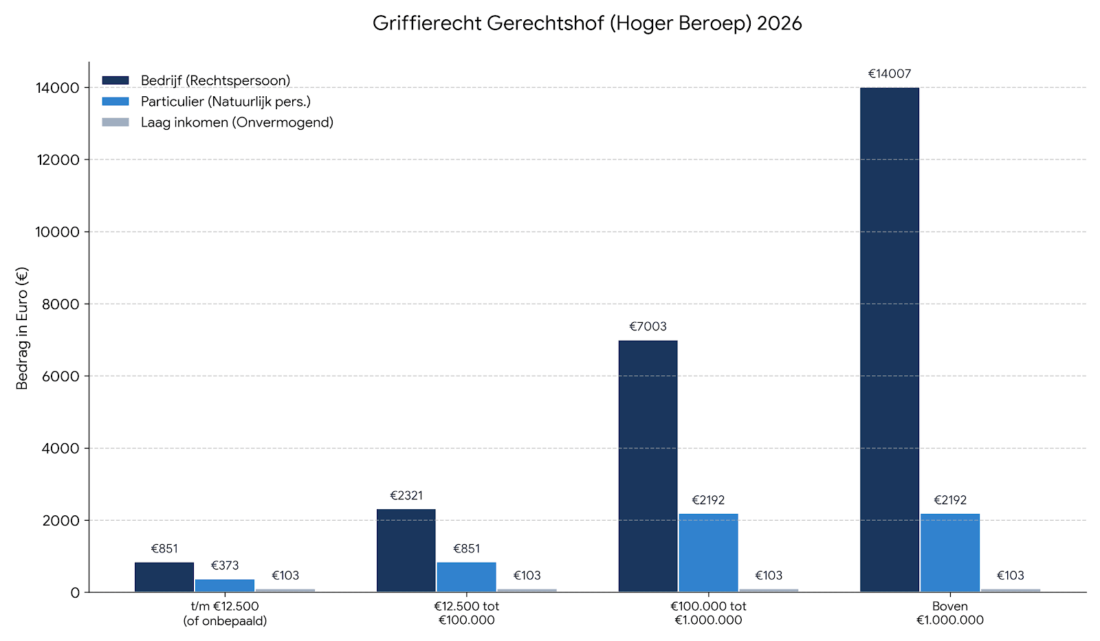

3. Rates court 2026 (appeal).

Do you disagree with a ruling? Then you can appeal to the court of appeals. The rates and scales at the court differ from the court. The low income rate here is also higher.

| Value of the business | Company (bv/nv/vof) | Person (self-employed/private) | Low income |

|---|---|---|---|

| Indefinite / up to € 12,500 | € 851 | € 373 | € 373 |

| €12,500 to €100,000 | € 2.321 | € 851 | € 373 |

| €100,000 to €1,000,000 | € 7.003 | € 2.192 | € 373 |

| More than €1,000,000 | € 14.007 | € 2.192 | € 373 |

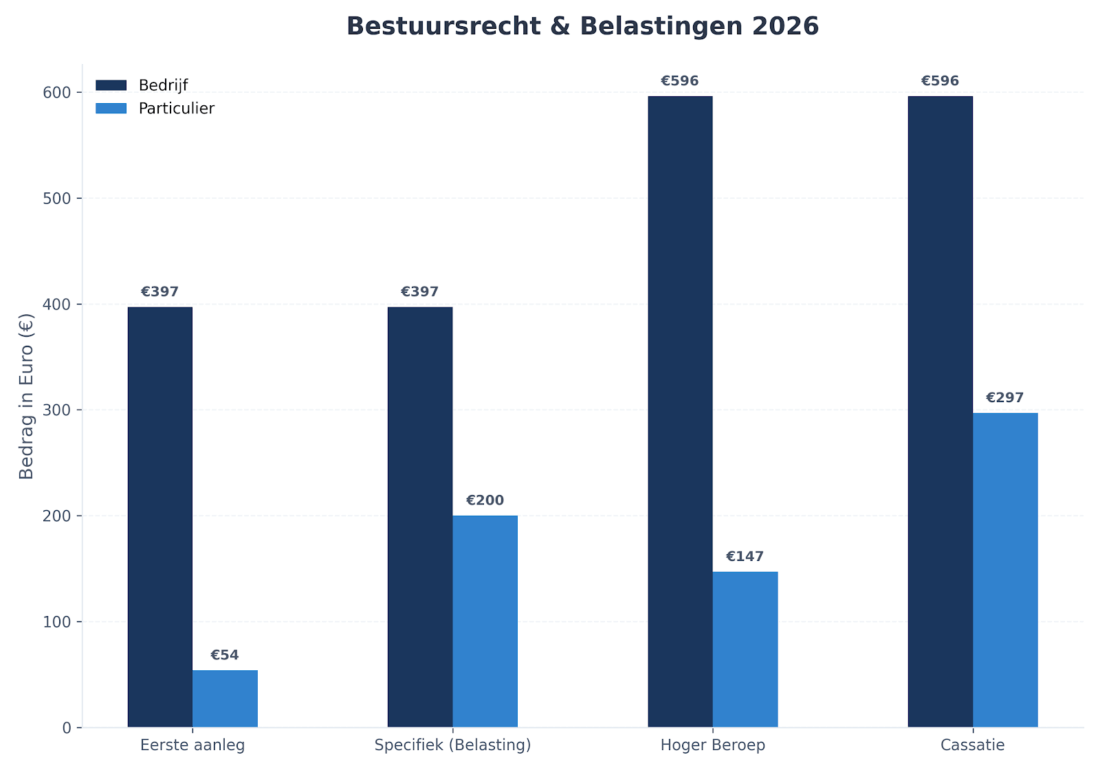

4. Administrative law and tax cases 2026.

Do you have a conflict with the municipality, province or tax authority and are appealing a decision? Then you pay court fees in administrative law.

| Type of procedure | Natural person (reduced rate) | Natural person (regular rate) | Legal person / organization |

|---|---|---|---|

| Appeal to the court | € 54 | € 200 | € 397 |

| Appeal | € 147 | € 297 | € 596 |

You see that for high claims, companies pay significantly more court fees than individuals. Therefore, it is important to calculate carefully in advance whether proceedings are worthwhile and what chance you have of recovering your costs.

Diagram fee civil 2026.

Diagram showing civil court clerk fees in 2026 (Civil Court Clerk fees in 2026?).

Diagram court fee appeal 2026.

Diagram showing appellate court fees in 2026 (Appeals in 2026).

Diagram of court fees administrative law and tax law 2026.

Diagram showing court fees in administrative law and tax cases in 2026.

How does payment of the court fee work?

Not everyone can easily pay the court fee. Therefore, it is important to know exactly when to pay and what will happen if you don't do it on time.

When do you have to pay?

Once you officially start a case, you have to pay court fees. You will then receive a bill from the court and have 4 weeks to pay.

The point at which those 4 weeks start varies by type of procedure.

In summons cases, the time limit runs differently than in petitions. On rechtspraak.nl you can find the exact rules per procedure.

- In case of a subpoena: the term starts on the day after the first court hearing

- For a petition: the deadline starts as soon as you file the petition with the court

- For appeals: the deadline starts as soon as you officially indicate that you are appealing

The four-week period

Once the court has registered your case, you will receive the bill for court fees. You must pay it within four weeks.

Important to know:

- If you pay late, judge stops your case immediately

- You don't get a ruling on your case

- You usually still have to pay the court fee

The courts are strict about this. This is one of the most common mistakes made. Therefore, at Credifin, we keep a sharp eye on the deadlines so that you don't incur unnecessary costs.

What if you withdraw the case?

Sometimes the other party is so shocked by the subpoena that they pay up after all. You can then withdraw the case. If you do this in time, before the judge really gets down to business, you sometimes pay less or even no court fees. We also actively monitor this for you.

Waiver through special assistance

Do you have a low income? Then you can sometimes apply to your municipality for special assistance for court fees. The municipality looks at:

- Your income

- Your ability

- Your monthly expenses

If you meet the requirements, the municipality may reimburse part or sometimes all of the court fee.

How can you pay?

Payment can usually be made through:

- Pin payment at court

- Bank Transfer

No VAT on court fees

You don't pay VAT on court fees. So there is no extra percentage on top of it. That makes it just a little easier to estimate your total costs correctly.

Who ultimately pays the court fee?

In the Netherlands, the main rule is simple: the loser pays the litigation costs. That usually includes the court fee.

You win the case

If you win the case (for the most part), the court may issue a court cost order. This means that the opposing party must reimburse your court fees. In practice, you then recover the paid court fees through the opposing party.

You are partly right

If you are only partially right, the judge may decide to split the litigation costs. Sometimes you then both bear part of the court fee, or each party continues to bear their own costs.

You lose the case

If you lose the case, you don't get your own court fee back. Often, you also have to pay the opposing party's court fees, in part. It is therefore important to assess in advance how strong your case is. We will help you with an honest assessment.

Court fees and your collection process

Court fees are a hefty investment. That's why at Credifin we always look first at whether amicable collection without a court is possible. This saves time, costs and stress.

Does a legal step become necessary anyway? Then we'll look at it together:

- The amount of your claim, including interest, collection costs and any bailiff's fees

- The expected court fee in 2026 for your type of case

- Chances that your client will eventually pay, even after a judgment

You must first advance the court fee yourself in most cases. If we win the case, we try to recover it from the debtor through the courts. If the judge rejects your claim, you usually lose the court fee.

We calculate the costs and risks for you as precisely as possible in advance, so there are never any surprises.

Want to know if litigation and court fees are wise in your situation?

Are you unsure if legal action in 2026 is the right move? We are happy to calculate for you what the approximate court fee will be, what your chances are and what other options you have.

Together we choose the approach that fits your situation: clear, humane and as effective as possible.

Frequently Asked Questions

At the cantonal court (cases up to €25,000), as a defendant, you usually do not have to pay court fees to defend yourself. Does the case go to the civil court (cases above € 25,000)? Then you, as a defendant, do have to pay court fees to be allowed to tell your story. If you do not, you will automatically lose the case.

This is often confused. Court fees you pay to the court for the use of the judge. Bailiff’s fees you pay to the bailiff for delivering the official letter (the summons) and the garnishment. So they are two different bills.

For entrepreneurs and businesses, the costs of litigation, including court fees, are just business expenses. Thus, you can deduct them from your profit, thus paying less tax. For individuals, court fees are usually not deductible.

Then you have a big problem. The court is very strict with the 4-week deadline. If you pay late, your case will be declared “inadmissible.” The judge then doesn’t even look at your evidence anymore and the other side automatically wins. The annoying thing is: you then often still have to pay the court fee bill.

In most cases, yes. If the judge completely agrees with you, the other party will be ordered to pay your court costs. This includes court fees. Note: You must collect this amount from the other party yourself. If that person really does not have a penny (stripped bare), you may still not physically see the money back.

Yes, if you have a low income and few assets. You must then show an “addition” or a statement from the Legal Aid Board. In 2026 you will then pay the reduced rate of €93. Companies (BVs, NVs) never get a discount.

No, no VAT is charged on court fees. The government does not tax the cost of justice. Therefore, you will see exactly the amount on the bill that is in our tables.

If the opposing party pays suddenly just before the hearing and you withdraw the case, you usually don’t get the court fee back if the court has already put the case on the roll (the docket). Do you withdraw the case very early, before the court has incurred administrative costs? Then you can sometimes get a portion back. We always advise you on this.

Legal resources from our knowledge base

Subpoena serve: The official start of your lawsuit

Bailiff’s writ: legal certainty at every step