Contents of this page

- Debt collection in Germany in brief

- Cultural difference: Why just calling doesn't always work

- Our rates for Germany: clear and transparent

- The amicable process in Germany (Außergerichtliche Inkasso)

- German legal forms: who should you address?

- The legal process: the Mahnverfahren

- Streitiges Verfahren: when your customer does defend

- Interest and prescription in Germany

- Why choose Credifin for your German receivables?

- Tips to avoid trouble in Germany

Debt collection in Germany in brief

Germany is the Netherlands' most important trading partner. Products, services and digital solutions cross the border every day. In most cases this goes fine, but if a German customer does not pay, you immediately notice the difference with a domestic invoice.

You have to deal with a different language, a different business culture and a different legal system. Where do you send your formal notice? How do you officially declare someone in default in German? And what exactly is a Mahnverfahren?

At Credifin, we help you get this right step by step. We specialize in cross-border debt collection and work with German files on a daily basis. In this file, you can read how debt collection in Germany works, what steps you can take and when we smartly take over for you.

Do you also work with Belgian clients? Then read our article on debt collection in Belgium. For Dutch claims, you can read more about the collection process and submit a collection directly online.

Cultural difference: Why just calling doesn't always work

To successfully collect in Germany, you must first understand who you are doing business with. German business culture differs markedly from Dutch business culture. Where you might want to call to resolve it, your German customer expects something completely different.

In the Netherlands, we solve many things informally. We call, look for a solution together and keep the tone light-hearted. In Germany, it's more about clarity, structure and formal steps.

- Hierarchy: You don't just speak to the director of a GmbH if you work in administration yourself. Hierarchy is taken seriously.

- In writing: In Germany, "Wer schreibt, der bleibt" applies. Important agreements and notices of default belong on paper or by e-mail.

- Formal tone: People address each other with "Sie" and use titles. An overly loose or jovial tone in your reminder can appear unprofessional.

A sloppy or very informal Dutch reminder is often not taken seriously in Germany. If there is also an error in your invoice, your German customer often finds it logical to delay payment until everything is correct.

At Credifin, we therefore approach your German debtor in German: formally, legally correct, substantiated in writing and in correct German. This is how we show you are serious, without putting unnecessary pressure on the relationship.

Want to get your basics in order first? Then see how good accounts receivable management helps you spot problems earlier and prevent them.

Our rates for Germany: clear and transparent

Debt collection in Germany requires more work than a standard domestic debt collection. We have to consult German registers, apply German law and coordinate everything in German. That's why we work with a clear and simple pricing model. That way you know in advance where you stand.

- Starting fee: You pay a one-time €50 starting fee per file. This covers the initial costs for research, translation and administration.

- Collection fees: Upon success, we charge a 15 percent collection fee on the amount collected.

In Germany, a debtor who is in default must pay damages (Verzugsschaden). We try to recover these costs from your debtor as much as possible.

Want to know how this compares to our rates for Dutch cases? Then read more about our collection rates and how collection fees work.

The amicable process in Germany (Außergerichtliche Inkasso)

As in the Netherlands, in Germany we first try to find a solution without a judge. This is faster, cheaper and often better for the relationship. We call this the amicable process or Außergerichtliche Inkasso.

1. The notice of default (Mahnung).

We start with a formal and clear Mahnung. The debtor must unambiguously default (Verzug). Many German invoices already have a strict payment date on them. Once that date has passed, the debtor is in principle immediately in default.

Nevertheless, we always send a final, sharp summons in flawless German. This states exactly what is outstanding, which term still applies and what the consequences of non-payment are. Thus, the basis is legally sound.

2. Communication in one's own language

"Ich habe das nicht verstanden" is a common excuse. By doing everything in German, we remove that argument. Our collection specialists and partners speak the language and know the tone that works in business collection cases.

We write, email and call the debtor in German and clearly explain what is outstanding and what steps will follow if payment is not made.

Want to know more about how we handle this in the Netherlands? Then first read how our collection process is structured step by step. The way we work in Germany follows logically from that.

German legal forms: who should you address?

Before we take legal action, we always check who exactly your contract partner is. The legal form determines who is liable and where you can get your money.

- GmbH (Gesellschaft mit beschränkter Haftung): Similar to a Dutch BV. The GmbH itself is liable, not the director privately, except in exceptional situations.

- UG (Unternehmergesellschaft): Also called mini GmbH. These are often young companies with little capital. Here we pay extra attention to creditworthiness and chances of redress.

- AG (Aktiengesellschaft): Similar to an NV. These are often large companies with a formal structure.

- GbR (Gesellschaft bürgerlichen Rechts): Similar to a VOF or partnership. Here, the partners are privately liable. This provides additional opportunities for recourse.

- Einzelunternehmen: The sole proprietorship. The owner is privately liable with his entire assets.

By matching the right legal form with the right person or legal entity, you avoid going after the wrong party. We do this for you by default when you file with us.

Want general background on legal action first? Then read our dossier on legal proceedings in the Netherlands. Many principles are similar, although the German system works differently in practice.

The legal process: the Mahnverfahren

Is your German customer still not paying despite all reminders? Then Germany has a strong asset: the Gerichtliches Mahnverfahren. This is a streamlined procedure for undisputed monetary claims. It is faster and cheaper than starting an extensive lawsuit right away.

Step 1: Mahnbescheid (order for payment).

We submit an application to the appropriate Mahngericht on your behalf. The court checks the form, but does not comprehensively evaluate the contents. If everything is completed correctly, the court sends an official Mahnbescheid to the debtor.

This document comes directly from the court and makes a big impression. For many debtors, this is the tipping point: now it feels really serious.

Step 2: Two weeks to respond

Upon receipt, the debtor has two options:

- Pay: Many debtors still pay, often including interest and fees.

- Widerspruch: The debtor objects if he disagrees with the claim.

Only if Widerspruch is filed does the case continue as an ordinary lawsuit.

Step 3: Vollstreckungsbescheid (enforcement order)

Does the debtor not respond within the deadline and still does not pay? Then we request a Vollstreckungsbescheid. This is an enforceable title, similar to a judgment in the Netherlands.

This title allows us to use a German bailiff (Gerichtsvollzieher) to seize wages, bank accounts or goods. Thus, your claim becomes enforceable.

Want more background on attachment and foreclosure? Then also read our article on the foreclosure process after a judgment.

Streitiges Verfahren: when your customer does defend

Not every German claim is uncontested. Sometimes the debtor crosses out on the form that he disagrees with the claim. He then files Widerspruch. The case is then transferred to the ordinary civil court (Zivilprozess).

Key points of interest:

- For claims over €5,000, you are required to hire a German lawyer (Rechtsanwalt).

- For claims under €5,000, you may theoretically litigate yourself, but we almost never recommend it.

Procedural rules, deadlines and formalities are strict in Germany. Even a small mistake can be detrimental. That is why we cooperate with a network of specialized German lawyers.

Does your case reach this stage? Then we will transfer your file warmly, ensure a clear transfer and you will continue to communicate with us in Dutch.

Do you doubt whether your case is suitable for legal proceedings, in Germany or in the Netherlands? Then read our roadmap for court fees and costs in 2026 and if in doubt, please contact us.

Interest and prescription in Germany

German law has clear rules about interest and statutes of limitation. If you use them properly, your claim can add up significantly over time. So waiting is rarely to your advantage.

High default interest (Verzugszinsen)

In business transactions between companies, the legal delay interest rate is high in Germany. The interest rate is 9 percentage points above the base rate. If a claim is outstanding for a long time, this adds up heavily.

With a debt outstanding for a year, the debt can easily be 10 to 12 percent higher due to interest and additional costs. This interest is meant to compensate you for your disadvantage due to the late payment.

Limitation period (Verjährung).

The general limitation period in Germany is 3 years. The catch is in the starting point: the period begins to run at the end of the year in which the claim arose.

If you deliver in February 2026 and the invoice remains unpaid, the statute of limitations does not begin to run until December 31 2026. Three years later, the claim can be time-barred if you don't take any interruption actions.

So don't wait until the last minute. Taking timely action will prevent a German court from considering your claim as time-barred.

Do you want to know exactly what the situation is in the Netherlands? Then read more about statutory interest in 2026 and the corresponding statute of limitations.

Why choose Credifin for your German receivables?

You may be wondering whether it wouldn't be better to hire a German collection agency directly. You can, but in practice you then often run into other challenges: language barriers, little insight into progress and higher down payments.

At Credifin, you combine the best of both worlds:

- Communication in Dutch: You simply communicate with your regular contact person in the Netherlands. We translate and arrange the steps to Germany.

- Knowledge of both systems: We understand the Dutch way of doing business and at the same time know German law and German debt collection culture.

- Transparent costs: You pay a fixed starting fee and a clear percentage upon success. No unexpected extra costs or long-term subscriptions.

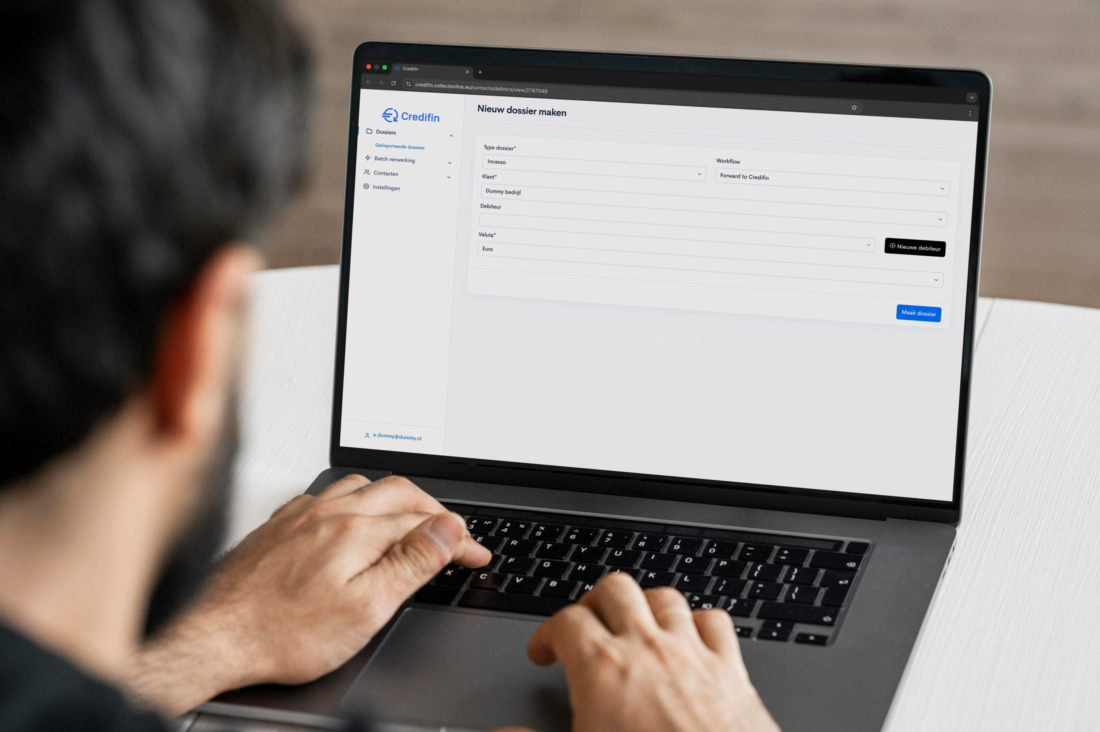

- One online portal: You manage all your files in our 24/7 Cockpit. You can see Dutch, Belgian and German claims in one overview.

- Fast and digital: We file digitally and keep the momentum going. No piles of papers or unclear wait times.

Want to learn more about who we are and how we work? Then read more about us or see step by step how it works when you work with Credifin.

Tips to avoid trouble in Germany

Ideally, of course, you want to prevent a German invoice from ever going to collections. With a few practical agreements, you reduce the chance of problems and are stronger if something does go wrong.

- Check your terms and conditions: Record which law applies and which court has jurisdiction. Where possible, choose Dutch law and the court in your area. This gives you more control in case of a conflict.

- Confirm everything in writing: Germans appreciate clear written communication. Always confirm quotations, orders, deliveries and changes by e-mail.

- Do a credit check: Are you supplying larger amounts to a GmbH or UG? Have us do a credit check beforehand. Then you'll know if you're doing business with a healthy party.

Do you work a lot internationally? Then it's smart to set up your internal processes accordingly. In our knowledge base you will find more background on outstanding invoices and smart management of your risks.

Start your German debt collection today

Do you have an outstanding invoice in Germany and are unsure what to do? Don't wait until the statute of limitations comes into view. For a one-time starting fee of €50 per file, we start the process immediately and take the right steps in Germany.

You submit your file completely online. We will contact your German customer, initiate the Mahnverfahren where necessary and keep you informed via our online portal.

Legal resources from our knowledge base

Boundless business, effective debt collection: international B2B receivables in 2026

Legal payment terms 2026: All the rules for B2B and consumers

Web store doesn’t refund money? Here’s how to get your money back!

Why borrowed money recovery is so difficult?

Compulsory settlement: what are your rights as a creditor in 2026?

Direct debit: Your debited invoice still paid out

Doubtful debtors in 2026: this is how you tackle them smartly