No, we advise against it. You must have officially closed the file with your current collection partner before we can get started. Two agencies on one debtor creates confusion and legal complications.

Recollection: what it is and when it makes sense

Re-collection is the resumption of a previously failed collection process. It often involves invoices from one to as much as five years old. Many entrepreneurs think that a file is finished if a previous collection agency was unable to collect it. In practice, a debtor's financial situation is constantly changing.

Where your debtor may not have had a penny to pocket three years ago, he may now have a thriving business or a steady income. With debt collection you respond to this new situation. We take another look at your file and set a fresh, well thought-out process in motion.

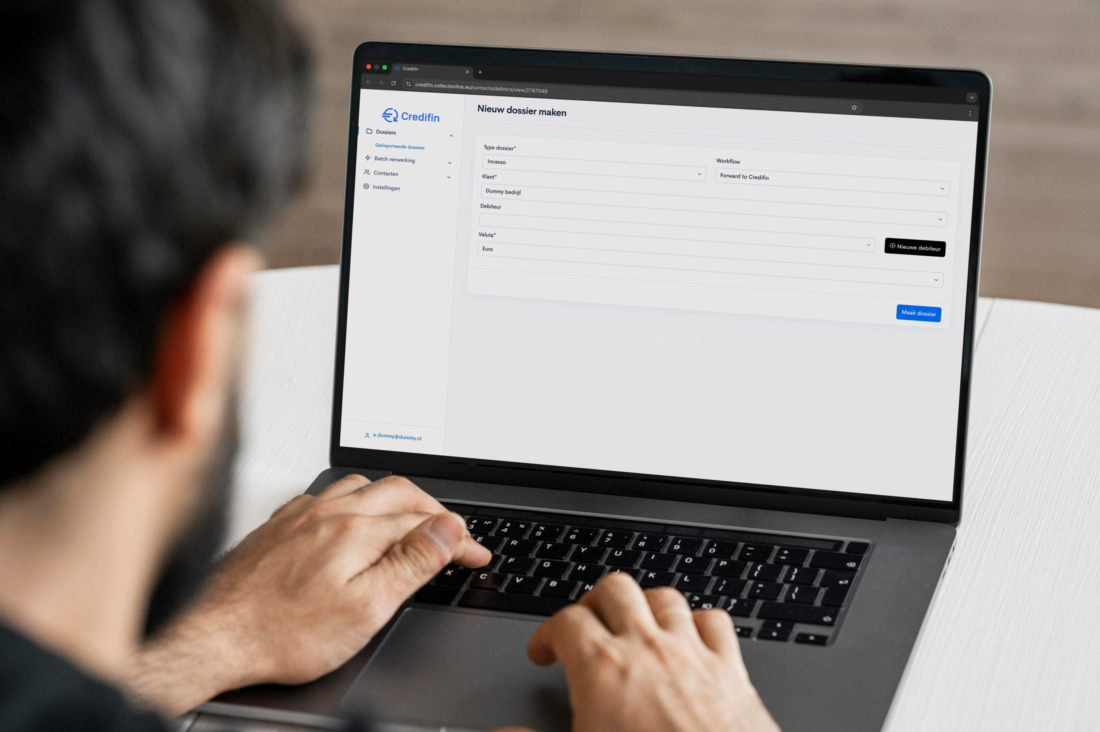

At Credifin, we do this completely digitally and transparently. In your Credifin Dashboard, you follow exactly what we are doing and what steps we are taking.

Why Credifin direct debit does work

Every collection agency works differently. Where others stop after a few standard letters, we look further. We are often successful in collecting files that have run aground.

That's why recollection works through Credifin:

- New incentive for your debtor: A letter from a new, decisive agency breaks the illusion that the debt has been forgotten.

- Large proprietary database:Our database contains data on tens of thousands of debtors. Chances are we already know your debtor from another file.

- Smart use of data: We check current data. Has there been a move? Is there now a private residence or a different employer?

- Nationwide Coverage: Through our network of bailiffs, we can still achieve results even in the foreclosure phase (such as garnishment) if necessary.

We combine technology, experience and a clear but respectful approach. This way, step by step, we increase the chances that you will still receive your money.

Want to know what our full process looks like? Then read more about our collection process.

The 50/50 deal: profit on written-off invoices

Re-collection files require more time, research and a more intensive approach. Often you have already zeroed out these invoices in your own administration. This is precisely why we work with a special 50/50 deal that is as simple as possible for you.

Here's how it works:

- No Cure No Pay: We work entirely on the basis of No Cure No Pay collection. If we collect nothing, you pay nothing.

- We collect everything from the debtor: We recover principal, interest and costs from your debtor, not from you.

- 50/50 split on success: Upon successful collection, you receive 50 percent of the invoice amount.

Without re-collection, are you catching nothing more on this file? Then every euro that still comes in yields unexpected profit. Better to receive 50 percent on a written-off invoice than 0 percent on a file that remains in the drawer forever.

Unsure if your file is appropriate? Feel free to get in touch via our contact page. We are happy to think with you.

When is your case suitable for recollection?

Not every old file is automatically a good candidate for re-collection. To maximize the chances of success, we follow a few clear guidelines.

- Minimum one-year break: It works best if there is at least 12 months between the last action of the previous collection agency and starting with us. During that time, your debtor's financial situation can improve.

- Claim not yet time-barred: Business claims usually expire after five years, unless you have timely interrupted the statute of limitations. The sooner you engage us, the more leeway we have to act.

- A clear file: You have at least the original invoice, basic details of the debtor and, if possible, the most important correspondence from the previous collection process.

Do you have several older invoices with the same customer? Then we can often bundle them into one re-collection process. That makes it clearer and more efficient.

Want to first better understand how to deal with outstanding invoices in general? Then read our comprehensive roadmap in the article Outstanding invoice: the full roadmap.

Here's how to start a recapture process at Credifin

How do you start a re-collection process?

Filing a re-collection case is almost the same as a regular collection order. You just add a few extra details so we can review your case quickly and properly.

- Create an account or log in

Don't have an account yet? Create it in a few minutes via Submit Collection. If you already have an account, you can log in directly to your Credifin Dashboard. - Upload your file

Upload the outstanding invoice and, if you have one, key letters and emails from the previous collection agency. - Indicate that it is a recollection

Please note in the description that it is a recollection and which agency handled the case previously. This allows us to move faster. - We assess feasibility

We check the statute of limitations, the information in your file and the signals we see in our systems. If we see good opportunities, we start the new process immediately.

Throughout the process, you keep track of progress via the dashboard. So you don't have to keep calling or emailing for an update.

Let us review your old files

Doubting whether your old invoices can still yield something? Send them in for re-collection and let us assess what is still possible, free of charge. You don't pay anything until we actually collect money for you.

You submit your re-collection file through the same portal as a regular order. It only takes you a few minutes and can still save you thousands of dollars.

Turn your archive back into a revenue source

Your old unpaid invoices are not useless archives. They are dormant capital. With recollection, you turn forgotten files back into a source of income.

At Credifin, we combine smart tools, up-to-date data and a personal approach. We approach your customer with respect, but clearly. That way we maintain the relationship wherever possible, while you get what you're entitled to.

Do you have some files in mind right now? Then don't wait too long. The sooner you engage us, the more likely we will still be able to pay you out.

Start filing re-collection immediately or get in touch first via our contact page. We will be happy to think with you about the best approach for your situation.

Frequently asked questions about Recollection (FAQ)

Sure. Especially with individuals, the financial situation often changes rapidly. Someone who was unemployed three years ago may now have a steady job. We find the entrance.

Cases that have already run with another agency are by definition “more difficult.” They require more detective work and a more intensive process. Because these are written-off receivables, this is a win-win situation: we take the full financial risk and you receive half of an amount you had already lost.

Absolutely. Many of our clients do a yearly “big cleanup” of their charged-off items. Do you have a list of dozens or hundreds of old files? If so, contact us. We can process them via bulk upload and perform a quick feasibility scan for each file.

For most business (B2B) claims, the statute of limitations is 5 years. For consumer (B2C) purchases, it is often only 2 years. However, if you (or your previous collection agency) have sent an official demand for payment in the interim, the statute of limitations has been “interrupted” and the period starts again. We always check this for you free of charge at the intake of a re-collection file.