In 2026, the statute of limitations is still 5 years after you discovered the mistake, with a maximum of 20 years.

What is an undue payment?

In basic terms, the law is very clear: you cannot keep money that does not belong to you. Do you make a payment anyway without a good reason? Then you speak of an undue payment.

In the Civil Code, this is stated in Article 6:203. In short: have you paid money to someone else without a valid reason? Then you have the right to reclaim that amount.

No legal basis: when can you ask for your money back?

An undue payment occurs when there was no legal basis for the payment. In other words, there was no obligation to pay. We call this the lack of a "legal basis.

You can usually reclaim if:

- There was no contract or agreement

- There was no outstanding invoice

- There was no court order forcing you to pay

- The payment was simply an error, such as due to an incorrect IBAN number

In 2026 we do almost everything through apps, QR codes and automatic payments. As a result, things also go wrong faster. Fortunately, the law protects you, but you have to take action yourself to get your money back.

Examples of undue payments

Undue payments are more common than you think. At Credifin, we see them come along every day. Below you'll see the most common situations.

1. A typographical error in the IBAN

You want to pay your rent or repay a friend, but you tap one digit wrong in the account number. Banks often have an IBAN Name Check, but it doesn't always work well. Especially not with business accounts or international payments.

Does the money then end up in the wrong account? Then you are usually entitled to a refund.

2. A double payment

You often see this in companies. The records are not quite up to date and an invoice is paid twice. For example, by both the accountant and the owner. Or a direct debit continues while you have already transferred the amount manually.

Again, the second payment is often undue.

3. Payment to the wrong supplier

You have two suppliers with almost the same name. In your banking environment, you accidentally choose the wrong one and transfer a large amount of money. The recipient sees the money coming in and keeps quiet.

In such a situation, you have no obligation toward this recipient. You can therefore recover the amount.

4. Expired subscription or contract

You have neatly terminated a subscription or contract, but the direct debit continues. From the end date there is no longer a valid legal basis. All payments debited after that are therefore in principle undue.

Why don't you get your money back right away?

You would think: anyone who receives money by mistake remits it immediately. In practice, it often works differently. People respond slowly or not at all. There are several reasons for this.

The psychology of the receiver

Common reasons why you don't see your money right away:

- Financial problems - The recipient is in debt and using your money to plug holes

- Laxity - People keep putting off repayment because it's a "hassle"

- Ignorance - Someone genuinely thinks they are entitled to the money, for example an old customer who thinks it is a back payment

- In bad faith - The recipient knows it's wrong, but hopes you don't discover the mistake

At Credifin, we know how to communicate with every type of recipient. We build up the pressure step by step, always within the rules and with respect. But clearly enough to get movement.

Roadmap: how to claim your money back

Have you accidentally transferred money or overpaid? This step-by-step plan will help you take the right actions quickly and in a structured way. Is it not working or do you want to outsource it? Then we can take over the process for you.

Step 1: Contact your bank directly

Discover the error shortly after payment? Then call your bank right away. In 2026, banks will have special procedures for undue payments.

- Ask if the payment has already been finally processed

- Ask if your bank can contact the recipient's bank

- Clearly explain that it is an undue payment

Note that your bank usually cannot unilaterally refund the money. But they can forward a refund request to the recipient.

Step 2: Send a clear written summons

Does the recipient not respond or refuse to repay? If so, send a written summons. This is important for your evidentiary position.

In this letter you put at least:

- The details of the payment (date, amount, description)

- That there is no legal basis for the payment

- A reference to Article 6:203 of the Civil Code

- A clear deadline to repay, for example, 7 or 14 days

- Announcement that you will hire a collection agency if payment is not made

Keep the letter and proof of mailing well. You will need this later if it comes to litigation.

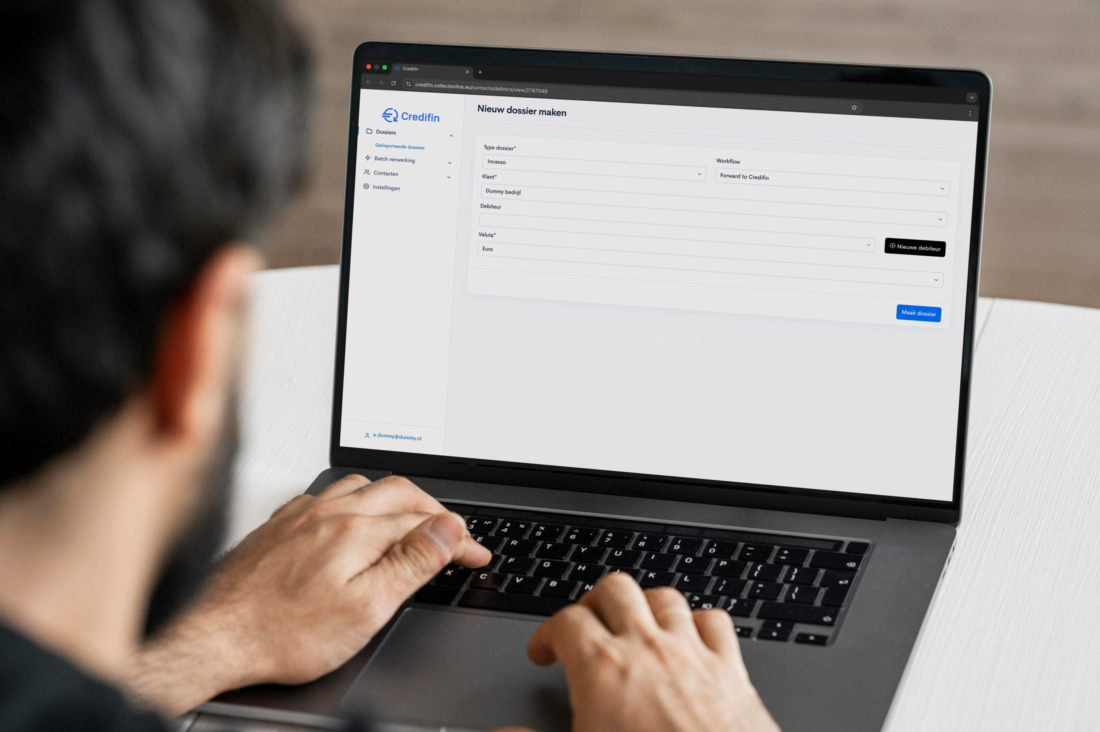

Step 3: Engage Credifin for your recovery

Does the recipient remain silent or deliberately hold the amount? Then it's time to call in a professional.

When you submit your file to us:

- We first check your legal position

- Start a clear summons process immediately

- Approach the recipient kindly but clearly

- In the amicable process, we work on a No Cure No Pay basis

Because a specialized collection agency is in between, we often see that the recipient suddenly does move.

When things get complicated: legal concerns

Not every undue payment is easy to resolve. Sometimes there are legal disputes or the recipient deliberately refuses to cooperate. This is when it is important to know your rights well.

In bad faith: did the recipient know it was wrong?

Can you show that the recipient knew he was not entitled to the money but kept or spent it anyway? Then he is in bad faith.

That has consequences:

- The recipient must repay the full amount

- In addition, he may owe statutory interest from the time he received the money

- He may also sometimes be liable for additional damages

Privacy, banks and the AVG

In some cases, the bank does not immediately release the recipient's information, citing privacy laws (AVG). That can feel like getting stuck.

Still, you have rights. Case law has ruled that under certain conditions banks may be obliged to share the recipient's name and address so that you can initiate civil proceedings. We can help you take the right steps towards the bank and use the right arguments.

Why Credifin for your undue payment?

Recovering an undue payment sometimes seems simple, but in practice you quickly encounter bumps in the road. The recipient doesn't respond, the bank has limited cooperation or a dispute arises over the right to the money.

At Credifin, we combine legal knowledge with a personal and incisive approach. That means for you:

- Watertight dossier construction - We make sure your file is correct and ready for any lawsuit

- A clear strategy - We determine together which steps make sense and when to scale up

- Nationwide coverage - Wherever the recipient lives in the Netherlands, we can pick up the file

- No Cure No Pay in the amicable process - No result, no cost to you in this part of the process

This way you keep a grip on your situation, without having to constantly chase it yourself. You focus on your business or private matters, we focus on your recovery.

Frequently Asked Questions

Yes, if the recipient is “in bad faith” (knew it was wrong) or fails to pay after your summons, legal interest accrues.

When refunds are refused, banks are conditionally required to provide the recipient’s name and address information to you for proceedings.

No, in a manual wire transfer, the bank cannot “reverse”. They need the cooperation of the recipient (or a judgment).

An undue payment, according to Article 6:203 of the Civil Code, means that an amount was transferred without a legal obligation, such as an invoice or contract, in return.

The law is implacable: the debt remains. The recipient must repay it out of pocket or through a scheme.

Recover your money quickly and professionally

Have you made an undue payment and notice that the recipient is not repaying on its own? Then don't wait too long. The sooner you act, the more likely you are to get your money back in full.

At Credifin, you can easily file a collection online. We will review your file, contact the recipient and start working for you immediately. Always clear, professional and with respect for all parties.

Legal resources from our knowledge base

Debt collection in Germany: How to get paid with our eastern neighbors

Boundless business, effective debt collection: international B2B receivables in 2026

Legal payment terms 2026: All the rules for B2B and consumers

Web store doesn’t refund money? Here’s how to get your money back!

Why borrowed money recovery is so difficult?

Compulsory settlement: what are your rights as a creditor in 2026?

Direct debit: Your debited invoice still paid out

Doubtful debtors in 2026: this is how you tackle them smartly