In a B2B relationship, this is allowed if it’s in your terms and conditions. In consumers (B2C), you may only charge after the 14-day period of the WIK letter.

What is a reminder?

A reminder is a formal and urgent request to your customer to still pay an outstanding invoice. The tone is more businesslike than in a regular payment reminder. You're not reminding. You're really exhorting.

In 2026, the reminder is an important part of your case construction. Will it later come to legal proceedings? Then you show with the reminder that you have repeatedly and clearly given your customer the chance to pay.

You usually send a reminder after you have sent at least one friendly reminder. This way you build pressure step by step, without immediately putting the relationship at risk.

The difference between a reminder and a demand letter

The difference is mainly in tone, timing and legal weight.

- Payment reminder: Friendly tone. You assume your customer has forgotten. You help remind and easily give some extra time.

- Reminder: Businesslike and clear tone. Your customer is really late now. You mention a hard deadline and name the possible consequences.

With the demand letter you indicate that the patient phase is over. You take a clear step towards follow-up steps, such as a final demand for payment or handing over the claim to a collection agency.

In practice, a three-step structure often works best:

- First, a friendly payment reminder

- Then a clear reminder

- Finally, a formal final demand letter or WIK letter

Want to know which step is best for your situation right now? Then also read:

Choose the step that suits your situation and read exactly what you can do.

Legal rules in 2026: what to look out for?

The rules around dunning notices were tightened in 2026 by the Quality of Collection Services Act (Wki). The existing rules on dunning fees, collection costs and statutory interest also continue to apply.

It is important to distinguish between business customers and consumers.

Business customers (B2B)

- You may refer directly to the legal commercial interest rate in your reminder. In 2026, that rate is 12.50 percent.

- You may also point out delay fees or handling charges if they are in your own terms and conditions.

- Payment terms among companies are often shorter. In your reminder, for example, you can mention a deadline of 5 or 7 days.

Consumers (B2C)

- With private customers, the demand letter is often the prelude to the legal 14-day letter, also known as a WIK letter.

- You may not charge legal collection fees until you have sent a proper 14-day letter and the deadline has passed.

- Pay close attention to the wording and date in that letter. If this is not correct, you may not be able to recover collection costs.

Do you doubt whether your reminder and 14-day letter comply with all the rules? Then you can outsource that to us. We'll make sure your file is correct if it ever gets to court.

Here's how to build a strong reminder

A good reminder letter leaves no room for misunderstanding. Your customer should see at a glance what you expect and what will happen if they don't pay.

Make sure at least these parts are clearly stated in your letter or e mail:

- Clear headline: Use the word ADDRESS in capital letters in subject and above the letter.

- Brief reference to previous contacts: Mention your previous reminder with date. This shows that your customer has had a chance to pay before.

- Outstanding invoice summary: Invoice number, invoice date, original due date and exact outstanding amount.

- Hard deadline: Mention a deadline for payment or a clear deadline. For example, "no later than 5 business days."

- Consequences for failure to pay: Announce that you are turning the claim over to Credifin and that additional costs will be borne by your customer.

- Easy payment option: Include a payment link or clearly repeat your payment information at the bottom of the letter.

Increase the pressure, but remain respectful. The clearer and more professional your reminder is, the more likely your customer will pay quickly.

Sample text reminder 2026.

You can use the text below as a basis if your customer still hasn't paid after the first reminder. Fill it in with your own information.

Subject: NOTICE: invoice [Invoice number] from [Your company name] is due and payable

Dear [Name of Debtor],

Despite our earlier payment reminder dated [Date], we have not yet received payment or response from you on invoice [Invoice Number]. The due date of this invoice has now passed by [Number of] days.

We urge you to transfer the outstanding amount of € [Amount] to us within 5 working days at the latest.

Pay directly via iDEAL: [Link to payment request].

Do we not receive your payment within the specified period? Then we are forced to hand over the claim for collection to our collection agency, Credifin. The associated collection costs and statutory interest will then be payable in full by you.

We assume you won't let it get to that point and would like to see your payment as soon as possible.

Yours sincerely,

[Your name]

[Your company name]

[Phone number]

[Email address]

Want to make sure your letter meets all the requirements? Then also compare this text with the explanation on our page about the final demand letter and the rules around collection fees.

Download free sample reminder (Word)

Want to use this sample text directly in your own letter? Then download the reminder as an editable Word document. All you have to do is fill in your own data, invoice number and amounts.

Do you also use our sample text for the final reminder? Then your entire reminder process will fit tightly together.

When do you move on to final demand or collection?

A demand letter is usually your last friendly warning. Does payment still remain unpaid after this letter? Then there is often more going on than just a forgotten invoice.

We advise in 2026 not to go on endlessly with reminders and reminders. In many cases, this is enough:

- First a payment reminder

- Then one clear reminder

- Finally, a formal final demand letter or WIK letter

After these steps, it's usually time to hand over your file. The longer you wait, the more likely your client will fall into deeper financial trouble and you will end up at the back of the line of creditors.

Switching gears on time helps you, but often your client as well. With a tight and clear process, less ambiguity remains and you can find a real solution faster.

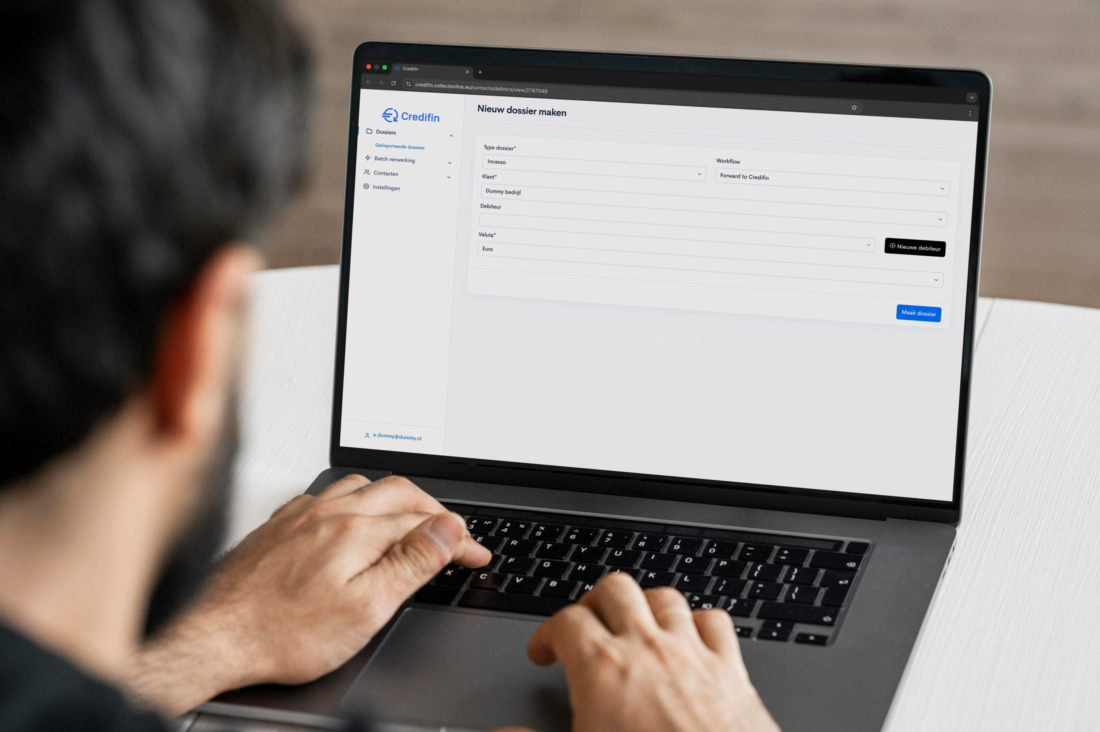

Get your reminders and collections taken care of by Credifin

Do you find it difficult to remain strict and tidy in your communications? Or do you simply not have time to update your accounts receivable list every week? Then we can take over the entire process for you.

- We send reminders, reminders and final reminders on your behalf

- We take into account all rules around Wki, WIK letter and collection fees

- In the amicable phase, we work on a No Cure No Pay basis. If your client does not pay, then in principle you pay nothing

This way, you keep your relationship with your client as good as possible and we ensure a professional and clear process.

FAQ on sending a reminder

If the debtor indicates disagreement with the invoice, stop the standard reminders and engage in conversation (or have Credifin do so). You won’t resolve a substantive dispute with a standard letter.

Yes, in 2026 a digital reminder is fully accepted legally. For added assurance, you can track in your e-mail software whether the mail has been opened.