With business customers (B2B), you may charge legal commercial interest from the day the payment period expired. With consumers (B2C), you may do so only after sending the 14-day letter.

Contents of this page

- Outstanding invoice: why acting fast pays off

- The psychology of the outstanding invoice

- Step 1: The friendly reminder (days 1 through 7)

- Step 2: The formal reminder (around day 14)

- Step 3: The WIK letter (mandatory for consumers).

- Step 4: Transferring your file to Credifin.

- How do you avoid outstanding invoices in the future?

Outstanding invoice: why acting fast pays off

An outstanding invoice is actually an interest-free loan that you involuntarily give to your customer. The more invoices remain outstanding, the greater the pressure on your cash flow. This inhibits your growth, creates turmoil and, above all, costs you a lot of time and energy.

The good news: with a clear roadmap and the right tools, you can tackle outstanding invoices quickly and neatly. You'll keep control of your cash flow while showing that you take your payment agreements seriously.

On this page, we show you:

- What steps you can take immediately after the due date

- When to send a WIK letter to consumers

- When it's smart to transfer your file to Credifin

- How to avoid outstanding invoices as much as possible in the future

The psychology of the outstanding invoice

An outstanding invoice is by no means always unwillingness. Often it's a matter of no priority. The invoice is at the bottom of the pile, or the mail has simply stalled.

In 2026 you see that many debtors respond faster to digital incentives than to a letter by mail. Consider:

- A clear email with payment link

- A personalized reminder by phone

- A message through an online portal

Your job as a business owner is to claim that priority in a neat but clear way. Not by threatening, but by being clear about agreements, deadlines and consequences.

Step 1: The friendly reminder (days 1 through 7)

Is the due date past? Don't wait weeks. A day after the expiration date, you can already take the first step.

Here's how to do it:

- Send a friendly email with the invoice number and outstanding amount

- Add a direct payment link, such as iDEAL or an online payment page

- Write in a positive tone: you assume your customer has simply forgotten

Sample tone: You probably overlooked the payment of invoice "[number]". "Would you still like to pay it within a few days?"

Call your customer briefly after three days if nothing has happened yet. A simple question like " Have you seen my email with the outstanding invoice?" is often enough to get things moving.

Step 2: The formal reminder (around day 14)

Remaining unpaid after your friendly reminder? Then it's time for a formal reminder. The tone becomes more serious, but remains neat.

In your reminder, at least put:

- A clear reference to the original invoice and your earlier reminder

- A hard new payment term, for example, 7 days

- Notification that this is the last chance to pay at no extra charge

With business customers, you can often already point out the possibility of collection costs and statutory interest at this stage. With consumers, stricter rules apply: you need a correct WIK letter first.

Step 3: The WIK letter (mandatory for consumers).

Is your customer a consumer? Then you may only charge collection costs if you have first sent a valid 14-day letter. This is also called the WIK letter.

In Step 3: The WIK Letter (mandatory with consumers), judges are stricter than ever. Is something wrong in your WIK letter? Then you are missing out on the right to collection fees.

Your WIK letter must include:

- State the exact collection fees you will charge for failure to pay on time

- Clearly explain that the customer still has 14 days to pay only the principal amount

- Indicate exactly when the 14 days start to run

Because of the Quality Collection Services Act (Wki), this letter must be error-free. One miscalculation or unclear sentence can be enough to cost you.

Want to make sure your WIK letter is correct? On our page about the WIK letter, we explain step by step what it should contain and how to calculate the charges.

Step 4: Transferring your file to Credifin.

Have you sent reminders, issued a formal demand letter and, if necessary, sent a proper WIK letter? If payment still does not occur, then it is time to transfer your file.

Why is this the right time?

- You have shown that your client has had multiple opportunities to pay for themselves

- You better meet the Wki requirements because your file is neatly constructed

- You stop wasting time on back calls and emails

When a debtor receives a letter or notice from Credifin, something changes in psychology. It is no longer a non-committal reminder from a supplier, but a serious claim through a Wki-registered collection agency.

At Credifin, you work on a No Cure No Pay basis. You run no financial risk: we only earn when you get your money. At the same time, we always remain polite and professional towards your client, so that you can keep the relationship as good as possible.

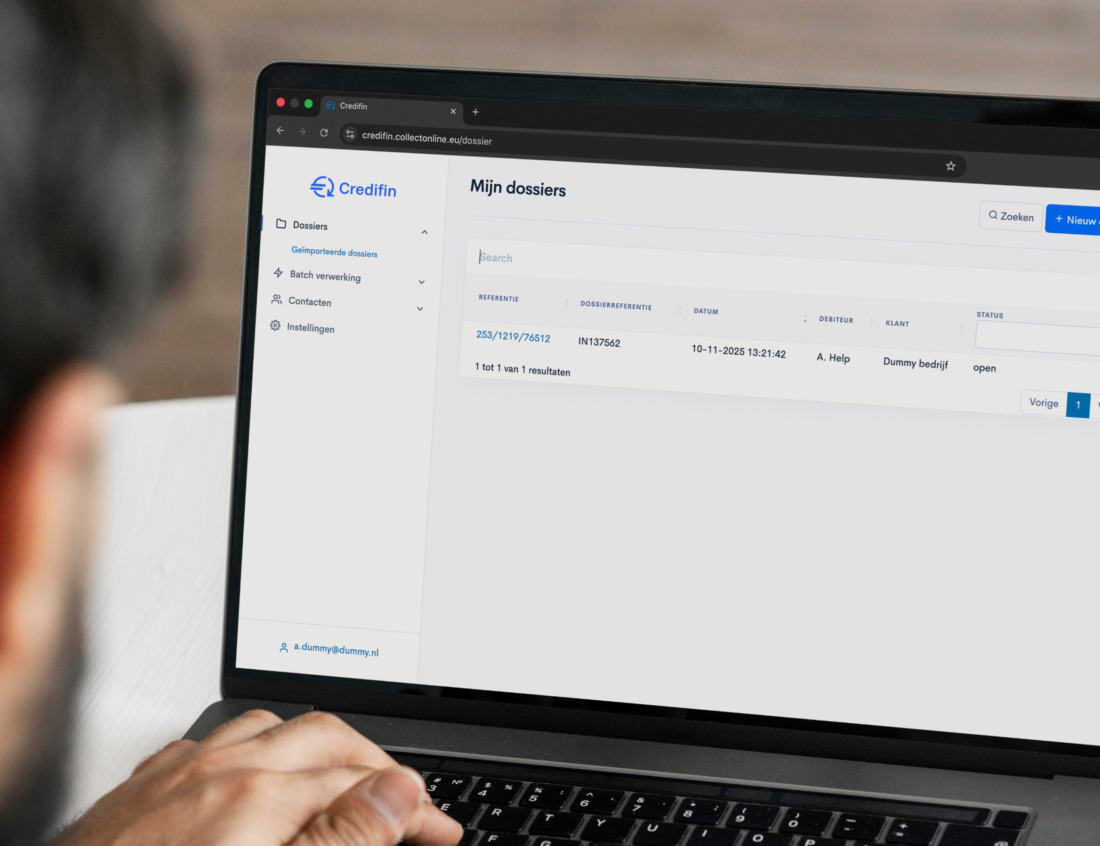

Want to transfer an outstanding invoice immediately? You can submit your collection order online in just a few minutes through Submit Collection.

In doubt about the right approach?

Not sure if you should use a collection agency already or send an additional reminder first? Send us your situation or give us a call. Together we will see what is the best and most friendly approach in your case.

How do you avoid outstanding invoices in the future?

Debt collection is necessary, but prevention is even better. With a few smart tweaks, you can greatly reduce the chances of outstanding invoices.

In any case, pay attention to these three points:

- Check new customers: For higher amounts, do a credit check first or ask for (partial) prepayment

- Be clear on terms: Put your payment terms and the consequences of late payment clearly in your terms and conditions and quotations

- Automate your process: Link your accounting to the Credifin Web portal so that reminders and transfer to collection are smooth and fast

This way you keep a grip on your debtors without having to deal with them on a daily basis.

Outstanding invoice? Transfer your file immediately

Have you gone through all the steps and your customer keeps not paying? Then it's time to take the next step. At Credifin, you can submit your collection order completely online. We take over the process from you, always with respect for your customer and according to the strictest Wki requirements.

You pay nothing if we don't collect anything for you. This way, you keep control of your risk and we take care of the follow-up.

Frequently asked questions about outstanding invoices (FAQ)

Once the agreed payment period (for example, 14 or 30 days) has passed without the full amount being in your account.

This is a common excuse. In 2026 we always recommend sending invoices digitally with a “read-receipt” or through a portal where you can see that the invoice has been opened. This is strong evidence in a legal case.

Yes, but pay attention to the statute of limitations. For most consumer sales claims it is 2 years, for business claims it is usually 5 years. So never wait too long to take action.

Want to know which step is best for your situation right now? Then also read:

Choose the step that suits your situation and read exactly what you can do.