Basically, the burden of proof is on the person who claims it was a gift. Especially with larger sums, the courts do not simply assume that you are giving away thousands of dollars without consideration.

- Why borrowed money refunds are so sensitive

- The legal basics: do you need a contract?

- What do you need to recover borrowed money?

- Roadmap: how to get your borrowed money back

- Private loan versus business loan

- What if there is nothing on paper?

- Litigating over borrowed money

- Reclaiming costs of borrowed money

- Why you can get borrowed money back with Credifin though

Why borrowed money refunds are so sensitive

Lending money almost always starts with trust. You want to help someone and assume it will be repaid neatly. But when the agreed date passes and you still haven't received anything, things get uncomfortable.

Maybe you feel embarrassed to bring it up. Or you keep being told that it "not a good time right now". Meanwhile, the amount remains outstanding and your irritation grows. This tension between money and relationship is what makes borrowing money so difficult.

Still, a deal is a deal. Whether you've put everything down tightly on paper, or only agreed via WhatsApp. On this page, we'll show you what options you have to get your money back, step by step.

The legal basics: do you need a contract?

Many people think they are hopeless if there is no official contract at the notary. That's not true. In the Netherlands, a verbal agreement is also legally valid. Agreements by e-mail can therefore be just evidence.

What is important is that it can be shown that there actually is a loan, that the term of the loan has expired and that it is not a gift. In legal proceedings, the judge looks at the whole picture: what was agreed upon, what was paid and how did the other party respond?

Want to read more about how proceedings work if it comes to that? Then check out our page on court proceedings.

What do you need to recover borrowed money?

The better you build your case, the stronger you will be. Therefore, gather as much evidence as possible before formally calling someone to account for repayment.

- Proof of the loan: A bank statement showing that you transferred the amount. Ideally with a clear description such as "loan" or "advance.

- Proof of deal: Messages via email in which the other person acknowledges that the money was borrowed and contains repayment agreements.

- Redeemability: Has the agreed term already passed? Or if there was no deadline, did you let it be known that you want the amount back now and put a date on it?

If you do not yet have this complete, that is no reason to do nothing. You can also collect additional evidence during the process, for example by the debtor responding in writing to your claim.

Roadmap: how to get your borrowed money back

Good news: you don't have to go to court right away. In many cases, you can achieve a lot with a clear step-by-step plan.

Step 1: The informal reminder

Always start friendly. Send a message or engage in conversation. Mention the amount, the original agreement and ask when you can expect payment.

- Stay calm and factual

- Avoid blame or emotional references to the past

- Ask for a concrete date or proposal for a payment plan

Step 2: The formal notice of default

Does the other person not respond or fail to pay? Then it's time for a formal step. You put the debtor"in default" with a clear letter or e-mail. In it:

- Name the amount borrowed and the background of the loan

- Refer to previous appointments or reminders

- Give you a final reasonable time to pay, such as 7 or 14 days

- Explain what the next step is if payment is not forthcoming (e.g. hiring a collection agency)

Note: Wki rules on private debtors

Do you lend money to a consumer and want to charge collection fees later? Then you have to deal with the Dutch Collection Services Quality Act (W ki) and the rules around the 14-day letter. You must first send the private debtor a correct final demand letter before you are allowed to charge collection costs.

- You name the exact amount of principal

- You clearly state how much collection costs you will charge if payment is not made on time

- You give the debtor at least 14 days to still pay free of charge

If your letter does not meet these requirements, you run the risk of not being allowed to claim collection costs. On our page about the Wik letter you can read exactly what such a letter must contain.

Step 3: Release the claim to Credifin.

Has the last installment expired and you still haven't received payment? Then the time has come to take it businesslike. By transferring your claim to Credifin, you take the emotion out of the situation and show that you are serious about it.

You can easily submit your collection order online via debt collection submission. We will take over contact with the debtor and initiate the amicable collection process.

Private loan versus business loan

Not every loan is the same. The tone and approach depend heavily on the relationship you have with the debtor and the background of the loan.

Business loan

Is it about a loan within a business relationship, such as to a business partner or another company? Then a tighter, formal approach is often appropriate.

- We refer to agreements and invoices made

- We can point to legal commercial interest

- We stress the importance of prompt and full payment

Mutual loan between friends or family

With loans between individuals, the situation is more sensitive. You want your money back, but preferably without breaking the relationship.

- We choose an understanding and calm tone in the beginning

- We explore realistic payment arrangements

- We take into account your desire: maintain relationship or primarily secure the money

If a gentle approach does not work, we can increase the pressure step by step. You decide how far you want to go in this.

What if there is nothing on paper?

Even without an elaborate contract, you often have more in hand than you think. Just a bank statement showing that you transferred an amount of money can be an important starting point.

In practice, we see that debtors often provide crucial evidence of their own in their response. Think of messages like, "I can't pay now, but I will in three months". With such a message, the debtor acknowledges the debt. This can later weigh heavily in proceedings.

We help you record this kind of information properly and use it in the right way. Step by step, we build a file that will stand up in court.

Litigating over borrowed money

If the amicable process does not yield results, we can take the step to court together. That sounds big, but the subdistrict court is precisely for this type of monetary claim.

With a judgment in hand, we can use various means through the bailiff, such as:

- Seizure of salary or benefits

- Seizure of bank account

- In some cases, seizure of property, such as a car

We guide you through this entire process: from drafting the summons to executing the judgment. Want to familiarize yourself with the steps?

Then read more on our page about court proceedings.

Reclaiming costs of borrowed money

You want your money back, but don't want to step into a new cost risk. That's why we work on a No Cure No Pay collection basis in the amicable process.

- Does the debtor not pay? Then you basically pay nothing for the amicable process.

- Does the debtor pay? Then we recover the collection costs and interest from him or her.

- You will receive the full principal amount to which you are entitled.

Should legal proceedings be necessary, we will clearly discuss the costs involved in advance, such as court fees and bailiff fees. So you know in advance where you stand and can make a conscious choice.

Why you can get borrowed money back with Credifin though

Reclaiming borrowed money is often emotional, time-consuming and legally complicated. We'll take that piece of it off your hands so you can regain peace of mind.

- Human approach: We approach your debtor with respect, but clear about obligations.

- Legal knowledge: Even without a notarized contract, we know what evidence is needed and how to make your case strong.

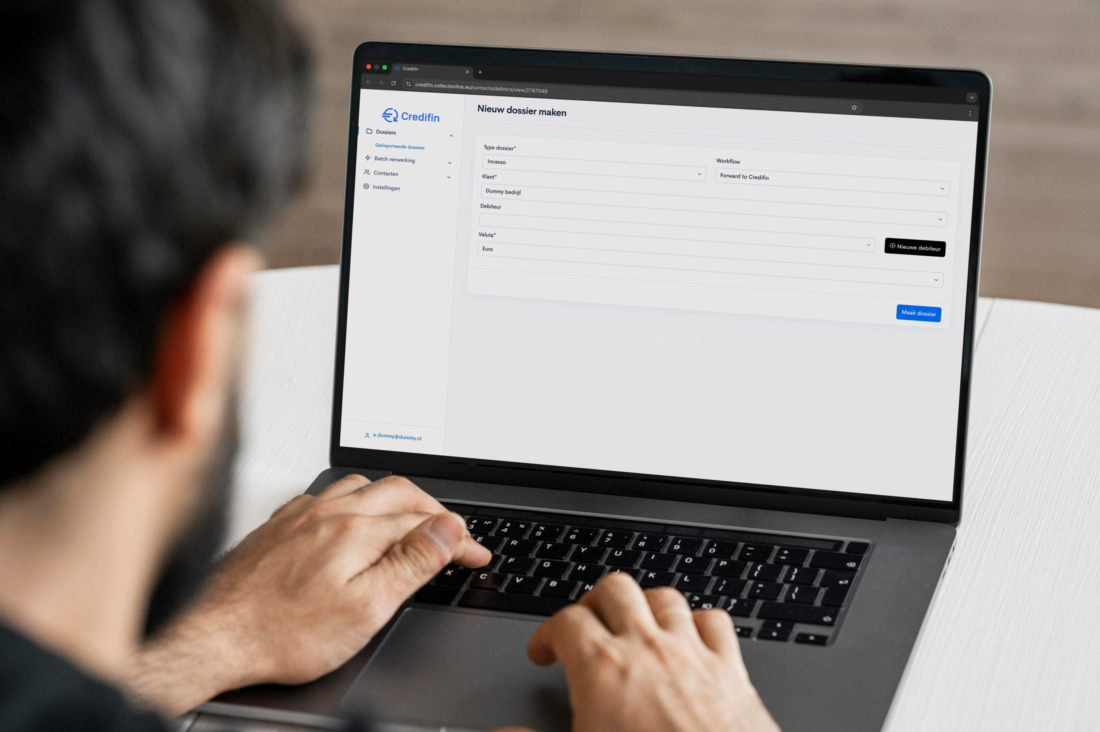

- Transparency: In our online portal, you follow the status of your case 24/7.

- Results-oriented: We do not stop after one letter, but continue as long as there are real opportunities to collect.

Don't let your kindness be abused. If you have lent money, you have a right to be reimbursed. We'll help you arrange that professionally and effectively.

Want to reclaim borrowed money? We'll help you from the first step

Are you about to formally appeal to a friend, family member or business partner for a loan? You don't have to do it alone. We'll look at your situation, think through the best approach, and gladly take over communication with the debtor for you.

You can create your file online in a few minutes. Then we'll get to work for you.

FAQ: Frequently asked questions about recovering money

A claim based on a loan generally lapses after 5 years after the claim becomes due and payable. However, you can extend this period by sending a letter of interruption.

If you haven’t agreed to this in writing, with private loans you are usually only allowed to charge statutory interest from the time the debtor defaults. With business loans, stricter rules for interest often apply.

This is the most common excuse. However, if there is a wire transfer with the description “loan,” or if there are emails talking about repayment, a judge will immediately sweep the argument of a “gift” off the table. We’ll help you present this evidence watertight.

In the amicable phase (without a judge), we often see results within 30 days. If litigation is required, it takes longer, but then you have the security of an enforceable title (attachment possibility).

In private debt collection (WIK) cases, collection costs are standardized by law. When we collect your money, we recover these costs from the borrower. So you get your principal back, and the borrower pays for the “inconvenience” he caused by not paying on time.

Without evidence, there is no legal basis. We do not want to give false hope. A collection process without evidence leads to nothing and only costs negative energy. We focus on cases where we can actually achieve results.

Legal resources from our knowledge base

Open bill: The complete roadmap for entrepreneurs in 2026

Verbal loan agreement: Are you entitled to your money without a contract?