Trade interest rates are directly linked to ECB interest rates. When inflation rose in Europe, the ECB raised interest rates to slow the economy. Because the statutory mark-up of 8% remains constant, the commercial rate rose along with it from 8% to the current 10.15%.

- What is statutory interest and why does it exist?

- Interest rates in 2026: current rates

- Historical review: 10-year statutory interest rate (2016 - 2025)

- When does legal interest start to accrue?

- Compound interest: the interest-on-interest effect

- The impact of the Wki on interest calculation.

- Contractual interest versus statutory interest

- How Credifin helps you get correct and optimal interest rates

What is statutory interest and why does it exist?

Is your customer not paying an invoice on time? Then you miss out on interest. The law solves that with the legal interest rate. This is a fixed percentage over the outstanding amount that you can charge from the moment your customer is in default.

The advantage for you: you don't have to prove the damages. The law simply says: money has a time value. Those who pay late must pay compensation in the form of interest.

In law, there are two types of legal interest. It is important not to confuse these.

- Statutory interest (Article 6:119 BW): For situations involving at least one consumer or for agreements between private individuals. It also covers many damages.

- Statutory commercial interest (Section 6:119a of the Civil Code): For commercial transactions between companies or between companies and the government. So for B2B invoices for delivered products or services.

If you take the wrong percentage, then your calculation is incorrect and you run the risk of an audit or legal proceedings. In our knowledge base you can read exactly how to handle this correctly in the step-by-step plan for outstanding invoices.

Interest rates in 2026: current rates

The legal interest rate is linked to the European Central Bank's market interest rate. Due to the high interest rates in recent years, the rates in 2026 are hefty.

As of January 1 2026, the following rates apply:

| Type of interest | Application | Rate 2026 |

|---|---|---|

| Statutory interest | Consumers, individuals | 4.00% per annum |

| Statutory commercial interest | B2B and government | 10.15% per annum |

For your cash flow, this makes a big difference. Especially with higher invoice amounts or long-term arrears, interest rates can add up quickly.

Do you work a lot with business customers? Then the trading interest rate of 10.15% plays an especially big role. This is no longer a symbolic amount, but a serious part of your return.

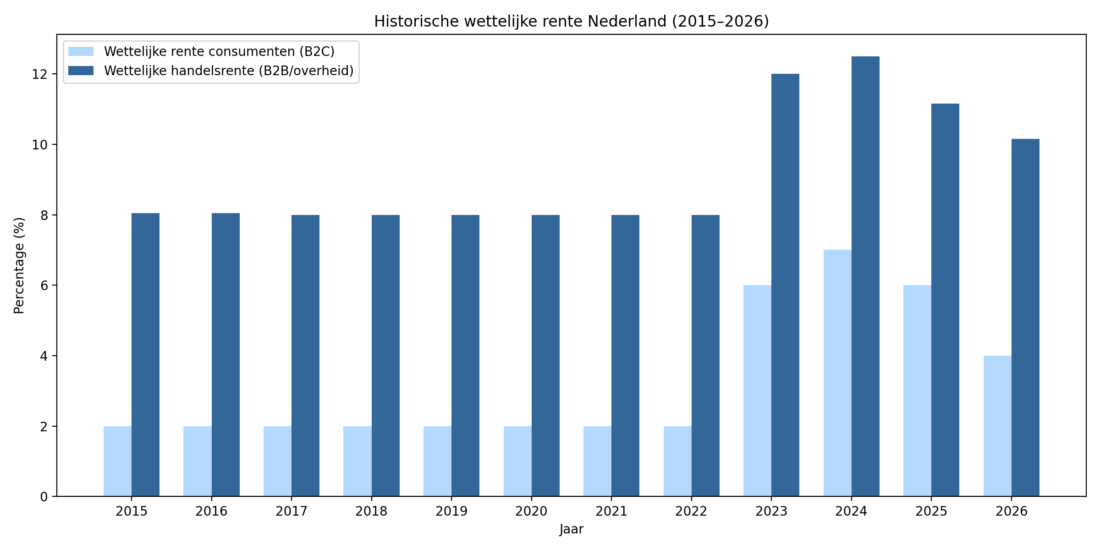

Historical review: 10-year statutory interest rate (2016 - 2025)

To understand why interest rates will be so impactful in 2026, it helps to look back. For years, money was almost "free," but rising ECB interest rates have completely turned the tide. Here are the historical rates you need for your calculations over the past few years.

Statutory interest in non-commercial transactions (B2C)

The government sets this interest rate based on economic and financial trends.

| Year | Percentage | Explanation |

|---|---|---|

| 2026 | 4,00% | Current year, see summary above |

| 2025 | 6,00% | Increase from previous years |

| 2024 | 7,00% | Long-term high level |

| 2023 | 4.00% (Jan) / 6.00% (July) | Two interest periods in one year |

| 2022 | 2,00% | Last year with low interest rate |

| 2021 | 2,00% | Stable low |

| 2020 | 2,00% | Stable low |

| 2019 | 2,00% | Stable low |

| 2018 | 2,00% | Stable low |

| 2017 | 2,00% | Stable low |

| 2016 | 2,00% | Beginning of the 10-year period |

Statutory commercial interest (B2B)

The commercial rate is linked to the ECB's refinancing rate plus an 8 percentage point premium.

| Year | Percentage | Explanation |

|---|---|---|

| 2026 | 10,15% | Current year, down slightly from last year |

| 2025 | 11.15% (Jan) / 10.15% (July) | Reduction from July 2025 |

| 2024 | 12,50% | Continuation of the high level |

| 2023 | 10.50% (Jan) / 12.00% (July) | Two increases in one year |

| 2022 | 8,00% | First clear increase |

| 2021 | 8,00% | Stable level |

| 2020 | 8,00% | Stable level |

| 2019 | 8,00% | Stable level |

| 2018 | 8,00% | Stable level |

| 2017 | 8,00% | Stable level |

| 2016 | 8,05% | Slightly different rate at the beginning of the period |

With this overview you can easily calculate back what interest you may apply to older invoices or long-term files. Keep in mind that in case of rate changes within one year, you must split the calculation per period.

Diagram of statutory interest 2015 to 2026.

When does legal interest start to accrue?

You may not charge interest from any date. You may charge legal interest only from the moment your customer is legally in default. That's the point at which your customer is officially late.

This works differently with business customers than with consumers.

In commercial transactions (B2B)

- Is there a clear payment date on the invoice? Then interest starts on the day after that deadline expires. For example: payment term 30 days, interest starts on day 31.

- Has no term been agreed upon? Then interest begins 30 days after the invoice date.

- You don't have to warn your customer separately first. The law assumes that businesses have their records in order.

With consumers (B2C)

- The consumer gets extra protection. You are not allowed to charge interest directly.

- In practice, interest usually begins only after a proper 14-day letter (notice of default) and the unused expiration of that period.

- Is that letter incorrect or is the deadline too short? Then your right to interest and collection fees may be in jeopardy.

Setting your payment terms properly and sending a correct final demand letter on time is therefore crucial if you want to claim interest. Want to know exactly what terms you are allowed to use? Then also read our article on the legal payment term.

Compound interest: the interest-on-interest effect

Many business owners are not aware that statutory (commercial) interest may be capitalized after each elapsed year. This means that after one year not only interest on the principal sum is due, but also interest on the interest already accrued. This possibility follows from article 6:119 paragraph 2 BW (for consumers) and applies accordingly to the statutory commercial interest pursuant to article 6:119a BW, unless the parties have agreed otherwise.

Simplified example : Business claim of €25,000 with 10.15% statutory commercial interest:

- Year 1: €25,000 + 10.15% interest (€2,537.50) = €27,537.50

- Year 2: interest on €27,537.50 = €2,795.06, new debt: €30,332.56

- Year 3: interest on €30,332.56 = €3,080.25, new debt: €33,412.81

After three years, the debt has increased by over €8,400, solely due to interest. This can have a particularly significant financial impact in the case of long-term arrears or procedures that last several years.

Important

Capitalizing interest must be calculated and explained correctly, verifiably and transparently. Since the enactment of the Debt Collection Services Quality Act (Wki) it is no longer sufficient to mention a global interest amount in a demand letter or summons. The structure of the interest must be transparent and verifiable for the debtor, especially in the case of compound interest over several years.

The impact of the Wki on interest calculation.

The Collection Services Quality Act (Wki) sets high standards for how you calculate and communicate interest. The days of a "rough estimate" on the summons are over.

In 2026, you must meet at least these points:

- Full transparency: You show for each period what amount you charge interest on, at what rate and on what exact dates.

- Correct split when rates change: Does the interest rate change during the year? Then split the calculation into separate periods with the corresponding rate.

- Good basis: You charge interest on principal and, after a year, on previously accrued interest. You never charge interest on collection costs.

If you try to do this yourself in Excel, it quickly becomes complex. Especially with partial payments and long maturities. An error in your calculation could result in a judge rejecting your interest (in part).

Want to make sure your file meets all Wki requirements? With a No Cure No Pay debt collection through Credifin, we check this fully for you.

Contractual interest versus statutory interest

Many business owners include their own interest rate in their terms and conditions, such as 1.5% per month. This is called contractual interest.

With business customers (B2B)

- In principle, you may agree on your own interest rate, as long as it is not unreasonably high.

- Is contractual interest clearly stated in your terms and conditions and have they been correctly declared applicable? Then this interest usually takes precedence over the legal interest rate.

With consumers (B2C)

- Judges are stricter. A very high contractual interest rate (for example, 15% per year or more) is often seen as unreasonably onerous.

- The court can annul such a clause entirely. You then fall back to the legal consumer interest rate of 4%.

So it's smart to have your general terms and conditions reviewed. This will prevent you from thinking you are entitled to a high interest rate, while the judge later puts a stop to it. So have your general terms and conditions regularly legally checked and updated.

How Credifin helps you get correct and optimal interest rates

Calculating interest manually may sound simple, but in practice it is complicated. Especially if there are partial payments or if a case has been going on for a long time.

Suppose your customer has a debt of €2,000 and pays €500 at once. On what amount do you then charge interest from the next day? First on the costs, then on the interest and only then on the principal amount. The law prescribes it in that order.

At Credifin, we take that work completely out of your hands:

- Our software calculates interest per day

- Each payment is automatically settled according to the legal order of priority (first expenses, then interest, then principal)

- You get a file that is 100% Wki-proof, with a clear overview of all interest periods

That way, you won't miss out on interest and you can explain with confidence how the total amount is built up, either towards your client or towards the courts.

Money is time, time is interest. Especially in 2026, with a trading interest rate of 10.15%, interest is an important part of your return. Make sure your billing process, your reminders and your collection process are set up accordingly.

Have the interest on your outstanding invoices calculated precisely

Want to be sure you are charging the correct legal or commercial interest rate and not missing a penny? Submit your debt collection online and we'll provide a complete, transparent and Wki-proof calculation of all interest and fees.

Frequently Asked Questions

This is a gray area that debtors often abuse. If a debtor suspends payment because they are dissatisfied with the delivery, but it later turns out that this was unjustified (or that the defect was minimal), then statutory interest is due retroactively for the entire period. The interest then serves as a penalty for wrongfully withholding payment. It is therefore essential in 2026 to have complaints legally assessed immediately so that the interest claim is not unnecessarily jeopardized.

When you agree to a payment plan, the legal interest rate counter does not automatically stop. Unless you explicitly agree to freeze interest (as a favor, for example), interest continues to accrue on the ever-decreasing outstanding balance. At Credifin, we process this daily: each installment payment received is first debited to the accrued interest and fees, and only then to the principal amount. This prevents you from still being left with an interest loss at the end of the settlement that has not been reimbursed.

Yes, absolutely. The VAT is part of the sum of money you are missing as a creditor. Since you have often already had to pay the VAT to the tax authorities, you suffer a direct loss of interest.

This is called contractual interest. In commercial transactions (B2B), you can agree on almost any rate (e.g., 1.5% per month). This then takes precedence over the legal interest rate. With consumers (B2C), however, the courts are very critical; an excessively high contractual interest rate is often annulled as ‘unreasonably onerous’, after which you fall back on the 4% legal interest rate.

Yes. If a debtor pays the invoice much too late, but “forgets” about the interest, that claim simply remains. You can even start a separate collection process for this. The statute of limitations for interest is 5 years.

Yes, the government has been treated as a professional party for several years now. Does the municipality or a ministry pay your invoice late? Then you are entitled to the high commercial interest rate of 10.15%.

Legal resources from our knowledge base

Credit checks in 2026: Navigate by data, not hope

Court fees 2026: Current rates and legal fees explained